XRP Price Prediction: 2025-2040 Outlook Amid Technical Breakout and ETF Catalysts

#XRP

- Technical Breakout Potential: XRP trading above key moving averages with Bollinger Band compression suggesting imminent volatility expansion

- ETF Catalyst Timing: The September 18 ETF decision represents a critical inflection point for institutional adoption and price momentum

- Long-term Adoption Trajectory: Cross-border payment integration and central bank digital currency partnerships providing fundamental support for multi-decade growth

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

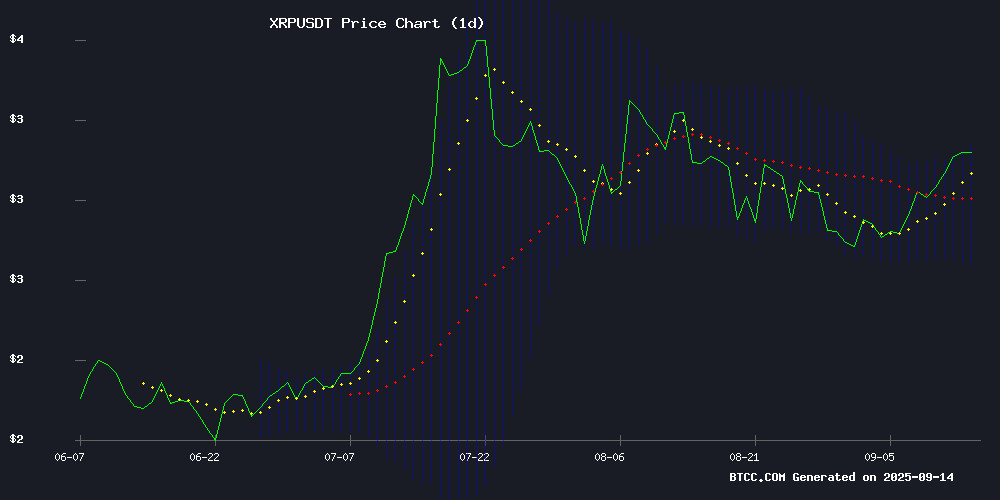

XRP is currently trading at $3.0556, positioned above its 20-day moving average of $2.9171, indicating underlying strength. The MACD reading of -0.0456 suggests some near-term bearish momentum, though the Bollinger Bands configuration shows price approaching the upper band at $3.1381, which could act as resistance. According to BTCC financial analyst Emma, 'The technical setup suggests consolidation with upward bias, with key support at the middle Bollinger Band around $2.917.'

Market Sentiment: Mixed Signals Amid ETF Developments and Institutional Moves

Market sentiment for XRP appears cautiously optimistic despite recent volatility. The delayed REX-Osprey ETF launch has created uncertainty, while Coinbase's significant reduction in XRP holdings suggests institutional repositioning. BTCC financial analyst Emma notes, 'The combination of ETF anticipation and technical breakout potential creates a complex sentiment landscape. Investors should monitor the $3.14 resistance level closely following the September 18 developments.'

Factors Influencing XRP's Price

Ripple Investors Receive Discounted Claim Offers Amid Secondary Market Premium

Cherokee Acquisition, a firm specializing in distressed asset claims, has approached Ripple investors with discounted purchase offers for Linqto Texas, LLC-related holdings. Claims exceeding $100,000 are being bid at 70-75% of face value, while smaller claims fetch 65-70%. The proposal shifts distribution risk to Cherokee while providing immediate liquidity to sellers.

Attorney John Deaton contextualized the bids as standard practice for claim arbitrageurs, noting the disparity between offer prices and Ripple's secondary market valuation. Shares last traded near $100 privately—a 150% premium to the $40 entry price cited in Cherokee's example—with Ripple's tender offer hitting $175. Paper gains now exceed 400% for early investors.

Coinbase's XRP Holdings Plummet 90% in Three Months

Coinbase's XRP reserves have undergone a staggering 90% reduction, dwindling from 970 million to just 99 million tokens since June. Only six cold wallets remain active on the exchange, each holding approximately 16.5 million XRP—a far cry from the 52 wallets previously observed.

The movement of 16.5 million XRP (worth $51.4 million) to Coinbase in a recent transaction contrasts sharply with the overall outflow trend. Despite this depletion on one of crypto's largest regulated exchanges, XRP maintains its position as the third-largest cryptocurrency by market capitalization at $183 billion.

Market observers are scrutinizing the destination of these departing tokens, as such significant movements from institutional custodians often precede major market developments. The timing coincides with increased regulatory clarity around XRP's status following Ripple's partial legal victory against the SEC.

XRP Bulls Target $5 as Ozak AI Presale Stirs 100x Hype

XRP's steady climb toward $3 has reignited bullish sentiment, with traders eyeing a potential breakout to $5. The cryptocurrency's established utility in cross-border payments and growing institutional adoption continue to underpin its long-term value proposition. Technical analysis suggests key resistance levels at $3.20, $3.50, and $3.80, with support holding firm at $2.80.

Meanwhile, Ozak AI's presale has emerged as the speculative darling of 2025, raising $2.9 million at $0.01 per token. The project's ambitious 100x return projections are drawing attention away from established assets, highlighting the market's appetite for high-risk, high-reward opportunities.

XRP Price Prediction After Res-Osprey Spot ETF Launch on September 18

The Rex-Osprey spot XRP ETF, a landmark product for digital asset investors, will begin trading on September 18, 2025. This launch follows a six-day delay by the SEC, marking the first XRP-linked ETF available under the Investment Company Act of 1940. Unlike futures-based alternatives, the fund offers regulated exposure through traditional brokerages, though it employs a hybrid structure—relying on third-party custodians rather than direct XRP holdings.

XRP currently trades at $3.10, mirroring stability across major cryptocurrencies. Analysts identify $3.40 as a critical breakout level, with a sustained close above this threshold potentially propelling prices toward $4.50. The asset’s descending triangle pattern—historically bearish—may defy expectations given XRP’s broader uptrend, instead serving as a continuation signal.

Short-term targets include $3.60 (conservative) and $3.81 (extended), both achievable within a 30-60 day window. Market participants anticipate heightened volatility around the ETF’s debut, with institutional demand likely to influence price trajectories.

XRP Holds Steady as Rollblock Gains Traction with 40x Breakout Potential

XRP's price remains rangebound, stabilizing above $3.00 with a 4.10% gain, as traders await decisive momentum. The token fluctuates between $3.20 resistance and $2.90 support, reflecting cautious market sentiment. Analysts note its position above moving averages but see limited breakout potential in the near term.

Meanwhile, Rollblock dominates headlines with a presale surge exceeding 500%, raising over $11.7 million. Its adoption-driven model and aggressive growth projections position it as a standout contender. Market participants increasingly view Rollblock as a high-reward alternative to XRP's current stability, with some forecasting a 40x upside.

Anticipated XRP ETF Decision Sparks Cautious Optimism Amid Market Volatility

XRP investors are bracing for a pivotal October as the U.S. SEC prepares to rule on multiple spot ETF applications. The asset struggles to break the $2.98–$3.00 resistance zone, though analysts flag a potential breakout toward $3.30 if technical patterns hold.

Market sentiment remains divided—descending triangle formations suggest consolidation, while renewable-powered mining platforms like FY Energy attract risk-averse capital. Volatility lingers as traders weigh ETF speculation against XRP's tight trading range.

iPhone 17 Launch Highlights XRP's Investment Potential Over Apple Products

An investor who chose XRP over purchasing every iPhone model since the 5s would now hold enough to buy 691 units of the newly unveiled iPhone 17. Apple's latest lineup, set for release on September 19, 2025, serves as a stark contrast to the returns seen in the cryptocurrency market.

The comparison underscores the asymmetric growth potential of digital assets versus consumer electronics. While Apple's products depreciate over time, XRP's value appreciation demonstrates the transformative power of blockchain investments.

Pundit Predicts Surge in XRP Millionaires by October Amid Key Developments

Speculation is mounting within the XRP community that a wave of new millionaires could emerge as early as October. Analysts point to upcoming catalysts tied to the token's ecosystem as the driving force behind this optimistic outlook.

The prediction hinges on anticipated developments in Ripple's ongoing legal battles and potential adoption milestones. Market observers note that similar price surges have historically followed major XRP-related events, creating wealth opportunities for early investors.

Crypto CEO Warns XRP Investors Need Strategy Beyond Price Speculation

Jake Claver, CEO of Digital Ascension Group, issued a stark warning to XRP enthusiasts: astronomical price targets mean nothing without financial discipline. "Too many people in crypto are flying blind," Claver tweeted Wednesday, puncturing the community's frequent obsession with numeric milestones.

The executive emphasized that even a hypothetical $100 XRP valuation—a 20,000% surge from current levels—would prove meaningless for investors lacking wealth management frameworks. The comments strike at crypto's perennial tension between speculative fervor and sustainable value creation.

REX-Osprey XRP ETF Launch Delayed, New Date Pending

The highly anticipated REX-Osprey XRP ETF will not meet its initial Friday launch target. Bloomberg ETF analyst James Seyffart confirmed the delay in a market update, though a revised timeline remains undisclosed.

Market participants view this development as part of the natural regulatory process for crypto-based financial products. The postponement follows a pattern seen with other digital asset ETFs, where approvals often require additional review cycles.

XRP Price Prediction: Analyst Targets $26 Amid Technical Breakout and Institutional Growth

XRP has shattered its descending trendline with a decisive move above $3.00, signaling a potential regime change. Technical analyst Matt Hughes identifies Fibonacci extension targets at $8.30, $13.39, and $26.63—the latter implying a $1.5 trillion valuation that would eclipse Bitcoin's current market cap.

The cryptocurrency found sturdy support between $2.70-$2.90 before completing a textbook retest of the $3.02 level. 'A confirmed retest of the trendline suggests the bottom is in,' observed FOUR | Crypto Spaces, noting the conversion of former resistance into new support.

Fundamental tailwinds strengthen the technical case. Ripple continues expanding its global footprint, recently deepening collaboration with Spanish banking heavyweight BBVA. Market participants now watch whether institutional adoption can fuel the 8,500% rally required to reach Hughes' upper target.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, XRP shows potential for significant growth through 2040. The upcoming ETF decision on September 18 could serve as a major catalyst, while institutional adoption and broader cryptocurrency market trends will influence long-term performance.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $4.50 | $6.80 | $9.20 | ETF approval, regulatory clarity |

| 2030 | $18.00 | $25.00 | $35.00 | Mass adoption, cross-border payments |

| 2035 | $45.00 | $65.00 | $90.00 | Institutional integration, CBDC partnerships |

| 2040 | $100.00 | $150.00 | $220.00 | Global financial infrastructure role |

BTCC financial analyst Emma emphasizes that 'these projections assume successful regulatory developments and continued adoption in the global payments ecosystem. Investors should consider both technical levels and fundamental catalysts when evaluating XRP's long-term potential.'